What We Do

VAT fillingSTARTER

popular- Up to 50 transactions per month

- Advisory on eligibility of VAT recoverability

- Quarterly VAT filing

- Monthly review of VAT transactions

- Summary of Input and Output VAT

- Summary of management review notes

GROWING

most popular- Up to 150 transactions per month

- Advisory on eligibility of VAT recoverability

- Quarterly VAT filing

- Monthly review of VAT transactions

- Summary of Input and Output VAT

- Summary of management review notes

PROMINENT

popular- Up to 300 transactions per month

- Advisory on eligibility of VAT recoverability

- Quarterly VAT filing

- Monthly review of VAT transactions

- Summary of Input and Output VAT

- Summary of management review notes with 1 hour online call

Optional Services:

Quaterly 1 hour meeting to discuss VAT filling / VAT recoverability eligibility / other VAT matters relevant to your business = AED 400 per hour

What we do

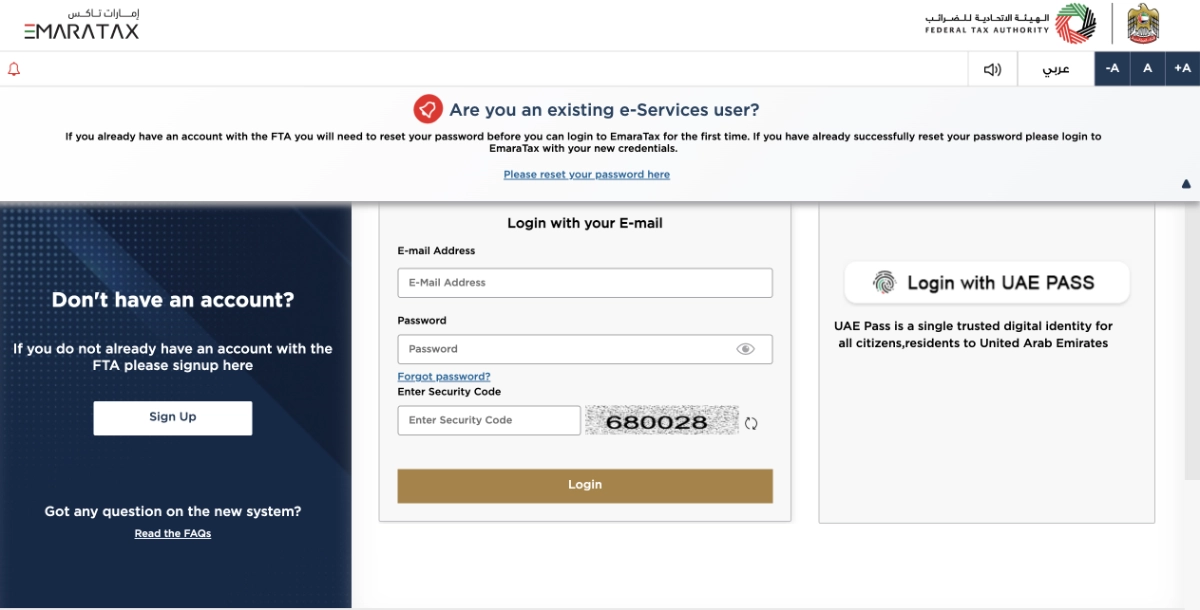

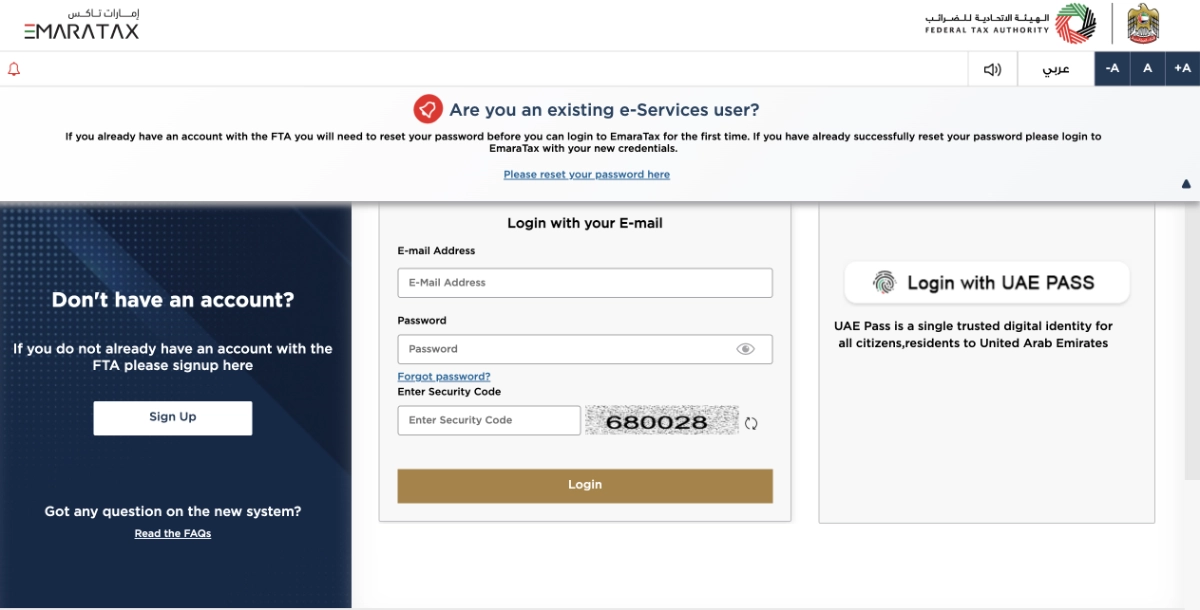

VAT registration

VAT registration fee = AED 1,000

Work provided:

- Review of Establishment Documents

- Submission of VAT application inclucind Arabic translation of certain fields

- Liaising with Federal Tax Authority (FTA) and regular follow ups

- Resubmission of the application as per FTA requests

Processing time for the application submission – up tp 2 working days from the receipt of the documents.

Processing time by FTA – up to 20 working days from the submission date.

VAT registration fee = AED 1,000

Work provided:

- Review of Establishment Documents

- Submission of VAT application inclucind Arabic translation of certain fields

- Liaising with Federal Tax Authority (FTA) and regular follow ups

- Resubmission of the application as per FTA requests

Processing time for the application submission – up tp 2 working days from the receipt of the documents.

Processing time by FTA – up to 20 working days from the submission date.

- Valid UAE Trade license

- Article of Association and any other establishment documents

- Owners and manager’s valid passport copy

- Owners and manager’s UAE valid resident visa copy and valid Emirates ID (if applicable)

- Contact phone number

- Company’s UAE bank account details in AED currency (Bank name; IBAN; SWIFT; Bank address). The corporate bank account must be operational and opened in the company’s name.

- Additional trade licenses of businesses in the UAE (if any) in which any of the partner is related to for last 5 years

- Turnover from the start of the trade license in AED on a monthly basis

- Expenses from the start of the trade license in AED on a monthly basis

- Projected turnover for next 30 days in AED

- Custom Authority registration details (if applicable)

- Title deeds if the owner owns any properties

- Expected amount of imports and exports and GCC supplies (for trading co only) in AED

- Sample sales invoices signed and stamped

- Sample expense invoices

Photo by Beatriz Pérez Moya on Unsplash.com

Free Consultation

Let's get started !

If you would like to learn more, why not to book a discovery call with me and find out more?